In today’s digital era, managing your finances should be as effortless as sending a text message. Traditional banks often bog us down with hidden fees, low interest rates, and clunky interfaces. That’s where Ally Bank steps in—a fully online bank that’s turning the financial world on its head with competitive rates, innovative tools, and a customer-first approach.

Whether you’re looking to maximize your savings, earn rewards on your spending, or invest for the future, Ally Bank offers a suite of products designed to help you make the most of your money.

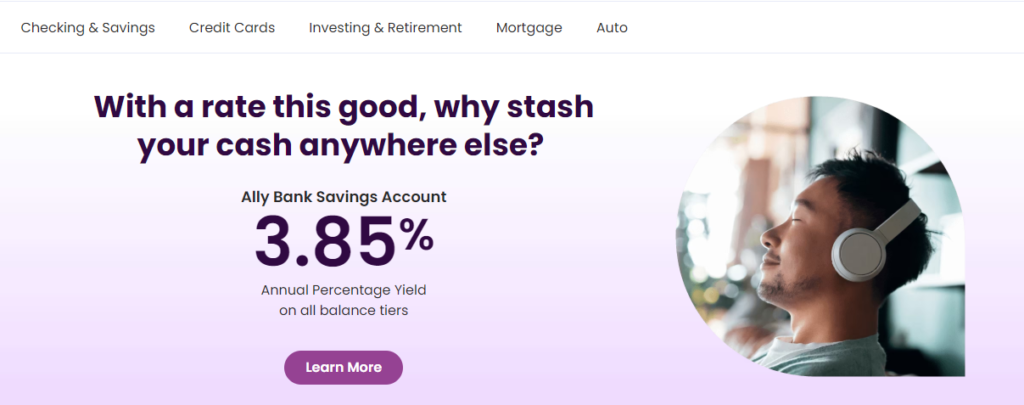

High-Yield Savings Account: Grow Your Money Faster

Competitive APY That Outperforms Traditional Banks

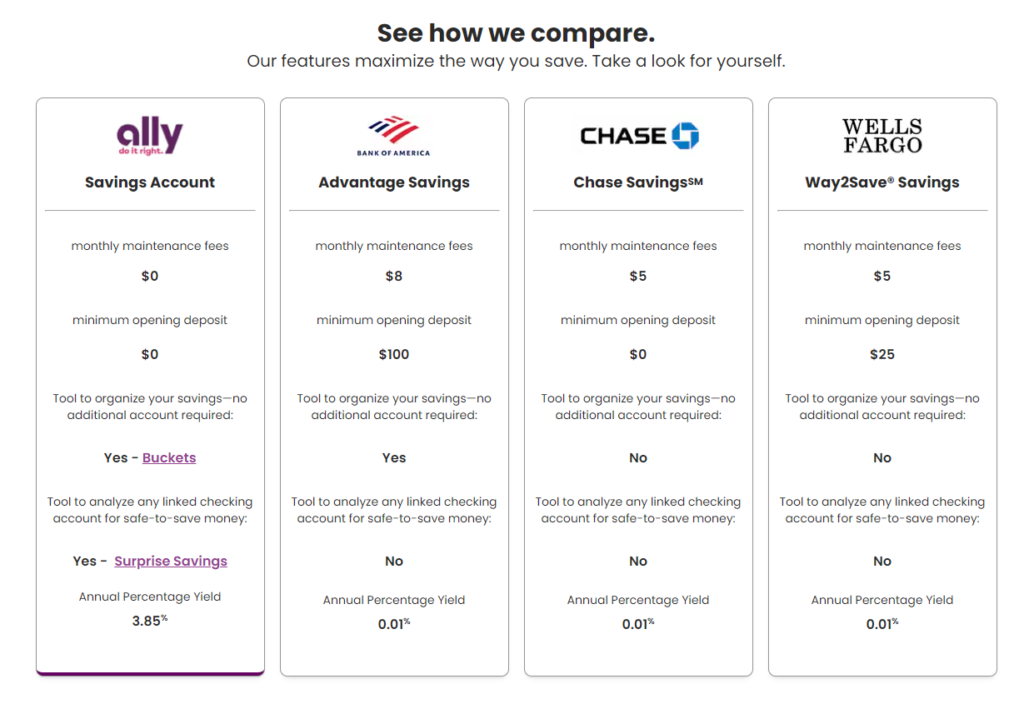

Ally Bank’s Online Savings Account offers a high annual percentage yield (APY) that consistently ranks among the best in the industry. While traditional banks might offer negligible interest rates, Ally ensures your money works harder for you.

👉 Check the latest rates here to see how Ally’s APY stacks up.

No Monthly Fees or Minimum Balance Requirements

Say goodbye to pesky maintenance fees and minimum balance hassles. Ally believes in transparent banking, so you won’t find any hidden charges nibbling away at your hard-earned savings.

Daily Compounding Interest

Interest in Ally’s savings account is compounded daily, meaning your balance grows a little more every single day. Over time, this can significantly boost your earnings compared to accounts that compound interest monthly or quarterly.

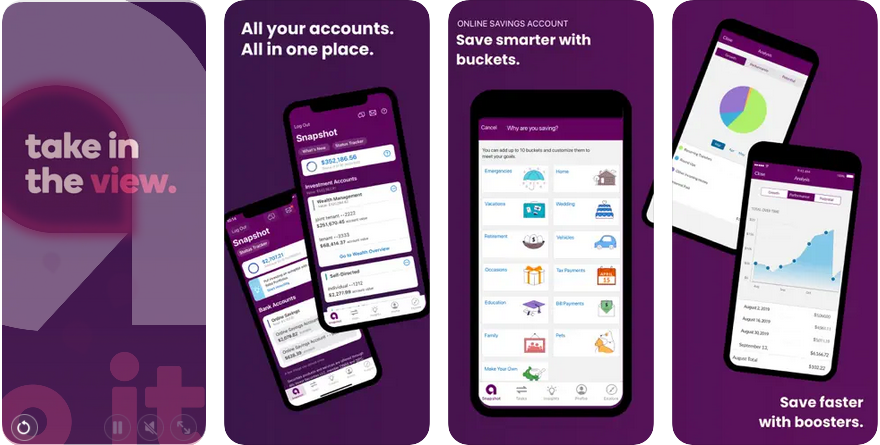

Savings Buckets: Visualize Your Financial Goals

Ally’s innovative Savings Buckets feature allows you to divide your savings account into up to 10 customizable buckets. Whether you’re saving for an emergency fund, a dream vacation, or a new car, you can allocate funds toward specific goals without juggling multiple accounts.

How It Works:

- Create Buckets: Set up individual buckets for each of your financial goals.

- Allocate Funds: Distribute your savings into these buckets as you see fit.

- Track Progress: Monitor how close you are to reaching each goal with visual aids and progress bars.

Boosters: Automate Your Savings Effortlessly

Ally takes the guesswork out of saving with Savings Boosters, a set of automated tools designed to help you save more without even thinking about it.

Round Ups

Every time you make a purchase with your Ally Bank debit card, Ally rounds up the transaction to the nearest dollar and transfers the difference to your savings account.

Example:

- You buy a coffee for $3.50.

- Ally rounds up to $4.00.

- $0.50 is transferred to your savings.

Surprise Savings

Ally’s algorithms analyze your spending patterns to identify safe-to-save amounts, automatically moving extra funds into your savings account when you can afford it.

👉 Ready to supercharge your savings? Open an Ally Bank Savings Account today and start making your money work for you.

Interest Checking Account: Simplify Your Daily Finances

While saving is essential, you also need a reliable checking account for your everyday transactions. Ally’s Interest Checking Account offers the convenience you need, along with perks that make managing your money a breeze.

Earn Interest on Your Balance

Yes, you read that right—Ally’s checking account pays interest on your balance.

- 0.10% APY on balances less than $15,000

- 0.25% APY on balances of $15,000 or more

No Monthly Maintenance Fees

Just like the savings account, Ally’s checking account comes with zero monthly maintenance fees.

ATM Access and Reimbursement

- Allpoint Network: Access over 43,000 fee-free ATMs nationwide.

- ATM Fee Reimbursement: If you get charged for using an out-of-network ATM, Ally will reimburse up to $10 per statement cycle.

Overdraft Protection Options

Ally offers multiple ways to protect you from overdraft fees:

- CoverDraft Service: Provides up to $100 in temporary overdraft coverage.

- Auto Transfer Service: Automatically transfers funds from your savings account to cover overdrafts.

- No Overdraft Fees: Ally doesn’t charge you for overdrafts up to $100.

User-Friendly Digital Experience

Manage your finances on the go with Ally’s top-rated mobile app and online banking platform. Features include:

- Mobile check deposit

- Bill pay and Zelle® payments

- Real-time transaction alerts

Ally Mobile App: Banking at Your Fingertips

In a world where your smartphone is practically an extension of yourself, Ally’s mobile app ensures that your bank is always just a tap away.

Intuitive Design and Seamless Navigation

The app boasts a clean, user-friendly interface that makes navigating your finances straightforward.

- Dashboard Overview: Get a snapshot of all your accounts in one place.

- Easy Transfers: Move money between Ally accounts or external accounts with ease.

- Face and Touch ID Login: Securely access your accounts using biometric authentication.

Robust Features for On-the-Go Banking

- Mobile Check Deposit: Deposit checks anytime, anywhere by snapping a photo.

- Instant Notifications: Set up custom alerts for transactions, balances, and more.

- Goal Tracking: Monitor your Savings Buckets and track progress toward your financial goals.

- Customer Support: Access 24/7 support directly from the app via chat or phone.

Security You Can Trust

- Advanced Encryption: Protects your personal and financial information.

- Multi-Factor Authentication: Adds an extra layer of security when logging in.

- Card Controls: Instantly freeze your debit or credit cards if lost or stolen.

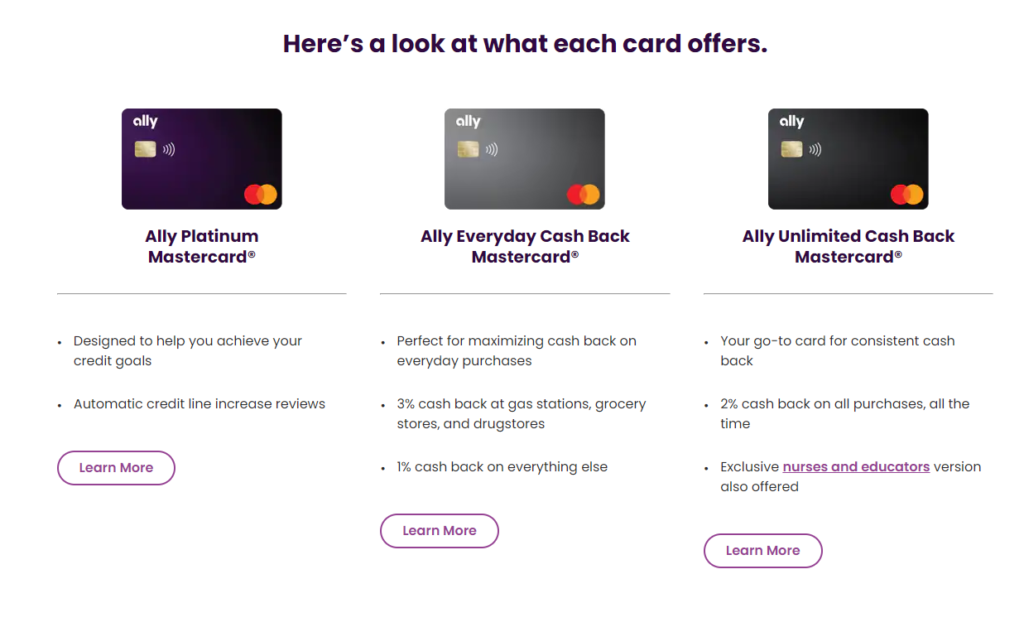

Credit Cards: Earn Rewards Without the Hassle

Ally Bank extends its customer-centric approach to its line of credit cards, offering options that cater to different financial needs.

Ally CashBack Credit Card

Note: As of my knowledge cutoff in September 2021, Ally offered the Ally CashBack Credit Card. Please check their website for the most current offerings.

Key Features:

- 2% Cash Back on eligible gas and grocery purchases

- 1% Cash Back on all other purchases

- Bonus Rewards: Earn an additional 10% bonus when you deposit cash back rewards into an eligible Ally Bank account

- No Annual Fee

👉 Interested in maximizing your rewards? Check the latest credit card offers here and find the card that suits your lifestyle.

Investing with Ally: Build Wealth Your Way

Whether you’re new to investing or a seasoned trader, Ally Invest offers platforms and tools to help you reach your financial goals.

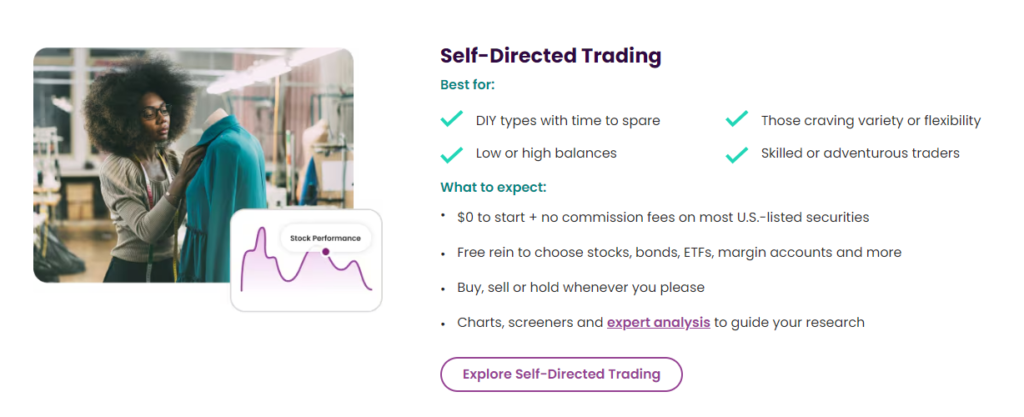

Self-Directed Trading: Take Control of Your Investments

- $0 Commission Trades on U.S.-listed stocks and ETFs

- Competitive Pricing on options contracts and other securities

- Robust Trading Tools: Access to research, market data, and customizable dashboards

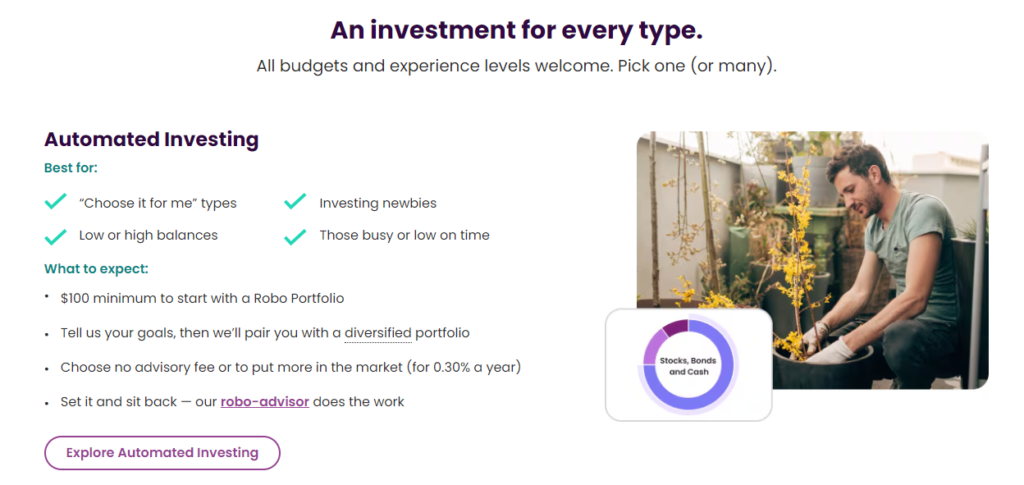

Managed Portfolios: Let the Experts Handle It

Prefer a hands-off approach? Ally’s Managed Portfolios offer automated investing tailored to your risk tolerance and financial goals.

- Low Advisory Fee: Only 0.30% annual advisory fee

- Diverse Portfolio Options: Choose from a range of investment strategies

- Automatic Rebalancing: Keep your portfolio aligned with your goals

Retirement Accounts

Plan for the future with Ally’s range of retirement accounts:

- Traditional and Roth IRAs

- IRA CDs and Online Savings Accounts

- Simplified Employee Pension (SEP) IRAs

Auto Financing: Hit the Road with Confidence

Ally’s roots in auto financing run deep, offering competitive rates and flexible terms to get you behind the wheel.

Auto Loans

- New and Used Vehicles: Finance the car that fits your lifestyle

- Flexible Terms: Choose a repayment plan that suits your budget

- Competitive Rates: Based on your creditworthiness

Ally Clearlane: Simplify Auto Financing

- Refinance Existing Loans: Potentially lower your monthly payment or interest rate

- Private Party Financing: Buy a car from another individual, not just dealerships

Home Loans: Unlock the Door to Your Dream Home

Ally’s Home Loans make buying or refinancing a home straightforward and hassle-free.

Competitive Rates and Transparent Pricing

Ally offers competitive interest rates with no hidden fees, making it easier to budget for your new home.

👉 Check the latest mortgage rates here to see how Ally can help you save.

Streamlined Online Application

- Pre-Approval in Minutes: Get an estimate of how much you can borrow quickly

- Digital Document Upload: Securely submit all required documents online

- Dedicated Home Loan Advisors: Receive personalized guidance throughout the process

Customer Service: Banking That’s All About You

Ally Bank prides itself on exceptional customer service, offering support when and how you need it.

24/7 Support

- Phone and Chat Support: Reach a real person any time, day or night

- Comprehensive FAQs and Help Center: Find answers to common questions quickly

Secure and Reliable Banking

- Advanced Security Measures: Encryption and multi-factor authentication keep your accounts safe

- FDIC Insured: Deposits are insured up to $250,000 per depositor

Pros and Cons: Is Ally Bank Right for You?

Pros

- Competitive Interest Rates: High APYs on savings and interest-bearing checking accounts

- No Hidden Fees: Transparent fee structures across all products

- Innovative Savings Tools: Features like Savings Buckets and Boosters set Ally apart

- Comprehensive Financial Services: From banking and investing to loans and credit cards

- Excellent Customer Service: 24/7 support with real human representatives

- User-Friendly Digital Experience: Highly rated mobile app and online platform

Cons

- No Physical Branches: Might not suit those who prefer in-person banking

- Cash Deposits Can Be Tricky: Limited options for depositing cash

- Potential ATM Fees Abroad: International ATM withdrawals may incur fees

Conclusion: Ally Bank—A Modern Solution for Modern Banking Needs

If you’re tired of low-interest rates, hidden fees, and outdated banking practices, Ally Bank offers a refreshing alternative. With competitive rates, innovative tools, and a comprehensive suite of financial products, Ally empowers you to take control of your finances like never before.

Whether you’re saving for a rainy day, looking to invest, or simply want a checking account that rewards you, Ally Bank could be the perfect partner on your financial journey.

👉 Ready to make the switch? Open an Ally Bank account today and experience banking that’s built around you.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Interest rates and product offerings are subject to change. Always check the official Ally Bank website for the most current information.